If you're a professional investor, chances are you use a data terminal.

It's no secret that investors rely on fast and accurate data to make investment decisions, and data terminals are the easiest way to get that. Fortunately for investors, there are lots of platforms to choose from, but finding the best for you or your organization can be a daunting task.

In this article, we analyze and compare the 5 best tools for investment professionals based on the following criteria:

Data Quality (Speed, Accuracy, Coverage, etc.)

Professional Tooling

Price

1. Fiscal.ai Enterprise

Fiscal.ai (formerly FinChat) is the fastest growing investment research terminal on the internet, and for good reason. Built by investors for investors, Fiscal.ai is powerful without compromise.

Fiscal combines institutional-grade data with a modern user interface, helping it rank the highest across all categories.

The platform provides feature parity and superior data quality compared to competing platforms, and offers it all at a much lower cost.

Global Data At Your Fingertips

Go from idea to confidence with clean global financial data. Trusted by the world's leading public market investors.

Data Quality:

Fiscal.ai is a comprehensive research terminal that provides investors 20+ years of fundamental data on all publicly traded companies globally.

Fiscal.ai is also the only platform on this list that provides real-time fundamental data. Most platforms require 24-48 hours to update their financial data since they rely on manual processes, but thanks to Fiscal's one-of-a-kind data aggregation engine, financials are updated within minutes of a company's earnings report.

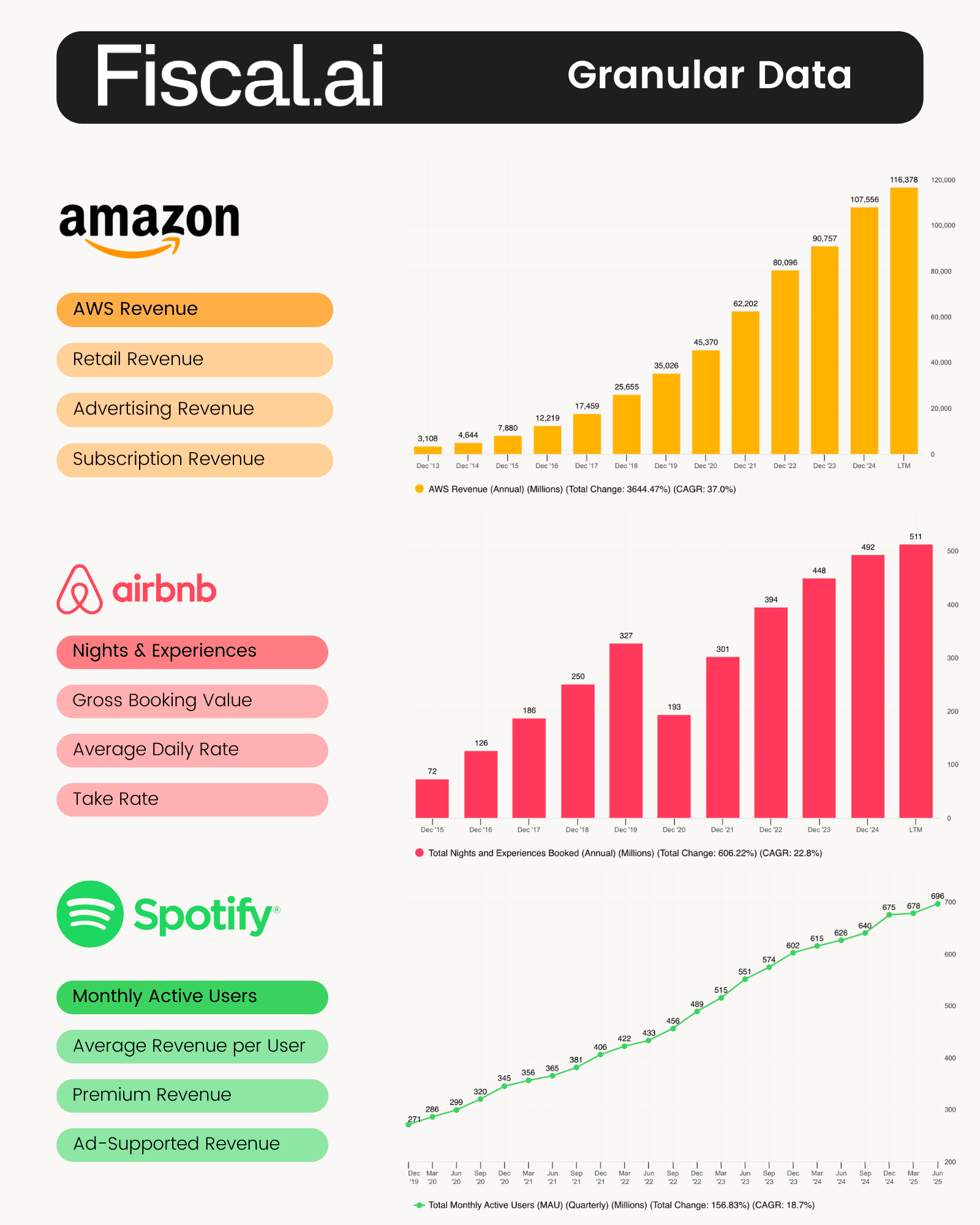

Standard financial data (Income Statement, Balance Sheet, Cash Flow Statement) are all presented to Enterprise users in both a Standardized and As-Reported format, but beyond traditional financial data, Fiscal.ai also has the largest Segment & KPI database on the internet.

Fiscal.ai tracks more than 1 million company-specific data points across 2,500+ companies globally. These granular, company-specific datapoints go a layer deeper than the headline numbers.

Professional Tooling:

Beyond Fiscal.ai's best in class data quality, the team has also built out a complete suite of tools and features that professional investors require.

Here are some of those critical features:

Click-Through Auditability: See the source of any datapoint with a single click.

Data Exporting: Export data directly into spreadsheets to build your own models.

Custom Metrics: Leverage Fiscal.ai's data to build and chart your own formulas.

Cross-Company Charting: Compare multiple companies across thousands of metrics in a single, intuitive charting tool.

News, Filings, Transcripts, & Research: Fiscal.ai provides dozens of additional resources needed to conduct qualitative research on a company.

AI Copilot: Fiscal's Copilot is pervasive across the platform and meets users where it matters most. Summarize documents, custom query transcripts, or use natural language for stock screening.

Data API: Pull Fiscal.ai's data into your own application using its various API endpoints.

Pricing

Fiscal.ai has several pricing tiers with varying capabilities, but their highest plan the Enterprise Tier.

The Fiscal.ai Enterprise Tier costs $250/month billed monthly or $199/month billed annually.

Enterprise comes with everything Fiscal.ai has to offer, including some enterprise-only features like data exporting, click-through auditability, and As-reported/Standardized financial statements.

Fiscal Enterprise includes team billing/onboarding with an intuitive organization control panel. Investment teams larger than 10 people are also eligible for custom contracts.

2. S&P Capital IQ

S&P Capital IQ Pro is a powerful platform that provides great breadth and depth of data across various industries and asset classes. It combines essential intelligence on millions of data points, including public company financials, estimates, ownership, transactions, and deep industry data.

Data Quality:

S&P CapIQ Pro has global data coverage and best-in-class accuracy. The platform provides comprehensive data on over 62,000 public and some data on 50 million private companies.

Beyond company fundamental data, CapIQ also provides some macroeconomic data and country risk scores.

Fundamental data is typically delivered within 24-48 hours of companies' reports.

Professional Tooling:

CapIQ Pro has many tools that work great for industry professionals such as data downloading, industry-specific research, AI document search capabilities and more.

Beyond traditional tools, CapIQ also offers specialized features for supply-chain intelligence through Panjiva and credit ratings data through its own ratings division.

Pricing:

S&P does not publicly disclose its pricing publicly, but estimates are that access to CapIQ can cost between $10,000-$30,000 per seat annually depending on the size of your team and product needs.

3. Bloomberg Terminal

Bloomberg has long been considered the industry standard for data terminals.

With over four decades of experience, it provides fast access to news, data, unique insights, and trading tools for leading decision-makers.

The user interface is complex and there's a steep learning curve to understanding the platform, but if you can afford one and need advanced trading/communication capabilities, this might be the right terminal for you and your team.

Data Quality:

Bloomberg has robust fundamental data coverage with top-tier accuracy. For those users also looking to combine trading execution with research, Bloomberg offers a unique end-to-end solution to meet those needs.

Bloomberg has data spanning all security types (credit, equities, options, and more) and covers virtually all global markets.

Professional Tooling:

Of all the platforms, Bloomberg has some of the most comprehensive professional tools available. From proprietary research to sophisticated pre- and post-trade analytics, Bloomberg offers a ton of functionality for pros.

Perhaps its most attractive tool is its integrated messaging system known as Bloomberg chat. If you are a frequent trader and particularly focus on illiquid securities, this chat can help in facilitating trading and sharing information with other users.

Pricing:

Bloomberg is often considered the most expensive terminal available.

For a single terminal subscription, pricing is estimated to cost $30,000 per year or $2,500 per month.

4. Factset Workstation

FactSet Quantitative Research offers an integrated platform for researching, optimizing, and constructing portfolios. The solution combines leading data and analytics with integrated quantitative research tools.

Data Quality:

Factset provides high-quality Standardized and As-Reported financials on global equities.

Beyond standard fundamental data, Factset also offers a host of alternative data solutions including ESG scores, ownership data, supply chain intelligence, and industry metrics.

Like CapIQ, Factset manually aggregates fundamental data to help ensure a high-degree of accuracy but can lead to 24-48 hour updating delays following earnings reports.

Professional Tooling:

Factset offers a variety of helpful research and portfolio optimization tools that can be useful for investors.

For research, Factset's customizable screens can help investors find companies, bonds, or funds that meet specific criteria.

As for portfolio analytics and optimization, Factset offers real-time alerts on holdings, price moves, and news. With the platform, you can also perform various scenario analyses by stress testing portfolios under different macro or market assumptions.

Pricing:

Factset operates on an a-la-carte model where pricing is dependent on all the individual features a customer might want. For a very basic version, subscription fees are typically around $5,000 per year, but for a more comprehensive package, estimates say it can cost as much as $50,000 per user per year.

5. Refinitiv Eikon

Refinitiv Eikon (now transitioning to LSEG workstation) is an end-to-end research and trading platform that integrates execution tools with portfolio analytics and global financial data.

Data Quality:

Eikon provides real-time market data across asset classes such as equities, fixed income, Foreign Exchange, commodities, funds, real estate, and more.

Refinitiv provides fundamental data for global equities in both an as-reported and standardized format. The company collects this data manually, which can lead to 24-48 hour delays, but helps ensure high accuracy.

Beyond its current financial data, Refinitiv also offers Datastream, which is its own time series database which can be great for backtesting.

Professional Tooling:

Eikon subscribers also have access to exclusive, high-speed Reuters reporting and editorials, through customizable news feeds.

Beyond news, Eikon provides equity research from ~1,300 global providers.

Like Bloomberg, Eikon also offers an integrated messaging system so that clients can communicate with one another for trading and sharing information. This can be a useful feature since Eikon works with more than 30,000 firms globally.

Pricing:

Refinitiv Eikon has several pricing tiers with gated functionality, but the average estimate for a subscription comes in at ~$22,000 per seat per year.

Try Fiscal.ai for Free Today!

See why it's the fastest growing equity research platform on the internet.