If you're building a finance or investing application, chances are you'll need a data provider.

Thankfully for builders today, there are several to choose from each with their own advantages.

But deciding which provider is right for you can take time, and pricing can be opaque.

That’s why we’ve put together this list.

This compares 5 of the most popular providers across several key categories:

Coverage (Geographies & Datasets)

Latency/Speed

Accuracy

Price

For each category, providers will receive a score of 1-3 (1 being poor, 3 being best-in-class).

Let’s dive in.

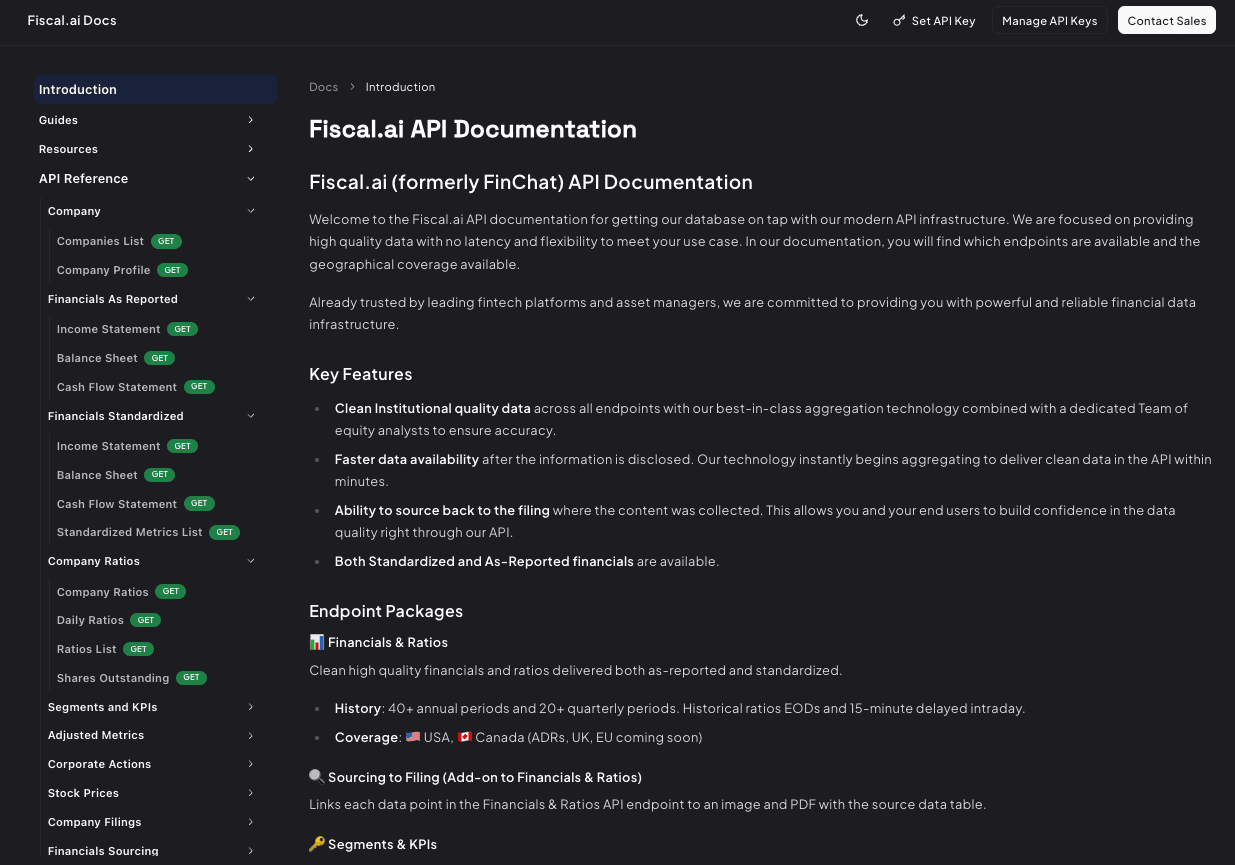

1. Fiscal.ai: Best for Company Fundamentals

Fiscal.ai is best known for its real-time financials and high-quality fundamental datasets.

Fiscal.ai's Data Feed offers 20+ years of Standardized and As-Reported statement data and ratios, 5+ years of non-GAAP adjusted metrics, consensus analyst estimates, and the world’s largest company-specific Segment & KPI dataset.

Segments & KPIs include metrics like:

AWS Revenue

Spotify's Monthly Active Users

Google's Paid Clicks Growth

What truly sets Fiscal.ai apart from the other providers on this list is its speed of data delivery. Fiscal uses a modern approach to data aggregation known as Human-in-the-Loop. This is a combination of modern AI detection and reasoning capabilities with manual oversight. This allows Fiscal.ai to update its financial data within 5-10 minutes of a company reporting its earnings, and with institutional-grade accuracy. Other providers take 1-2 days on average.

At the moment, Fiscal.ai’s Data Feed covers 75%-80% of global market capitalization, and they continue to add new geographies each month.

Fiscal.ai also offers one-click, source-to-filing technology so end users can automatically audit any numbers from the specific filings page with a single click.

This innovative approach to data aggregation is why many modern technology companies have turned to Fiscal.ai over the last 12 months.

Pros

Fiscal.ai is the leading provider for fundamental data on global equities.

Additionally, since Fiscal.ai is able to collect data at a lower cost than the manual aggregators, they’re also a more affordable solution than the 3 high-end providers (mentioned below). Fiscal.ai also offers a free trial of the API so you can validate the data yourself.

Cons

While great for fundamental datasets, Fiscal.ai does not offer much technical data. Their Datafeed does not include trading volume, bid/ask spreads, VWAP or other technical indicators.

Scoring:

Coverage (Geographies & Endpoints): 2/3

Latency/Speed: 3/3

Accuracy: 3/3

Pricing: 2/3

Combined Score: 10/12

Given the speed and depth of data, if you’re building an application for stock specific research, Fiscal.ai is likely your best choice.

See Fiscal.ai's full coverage here.

Talk to an Expert Today

Find the best provider for your project

Built For:

Investing Platforms

Institutional Investors

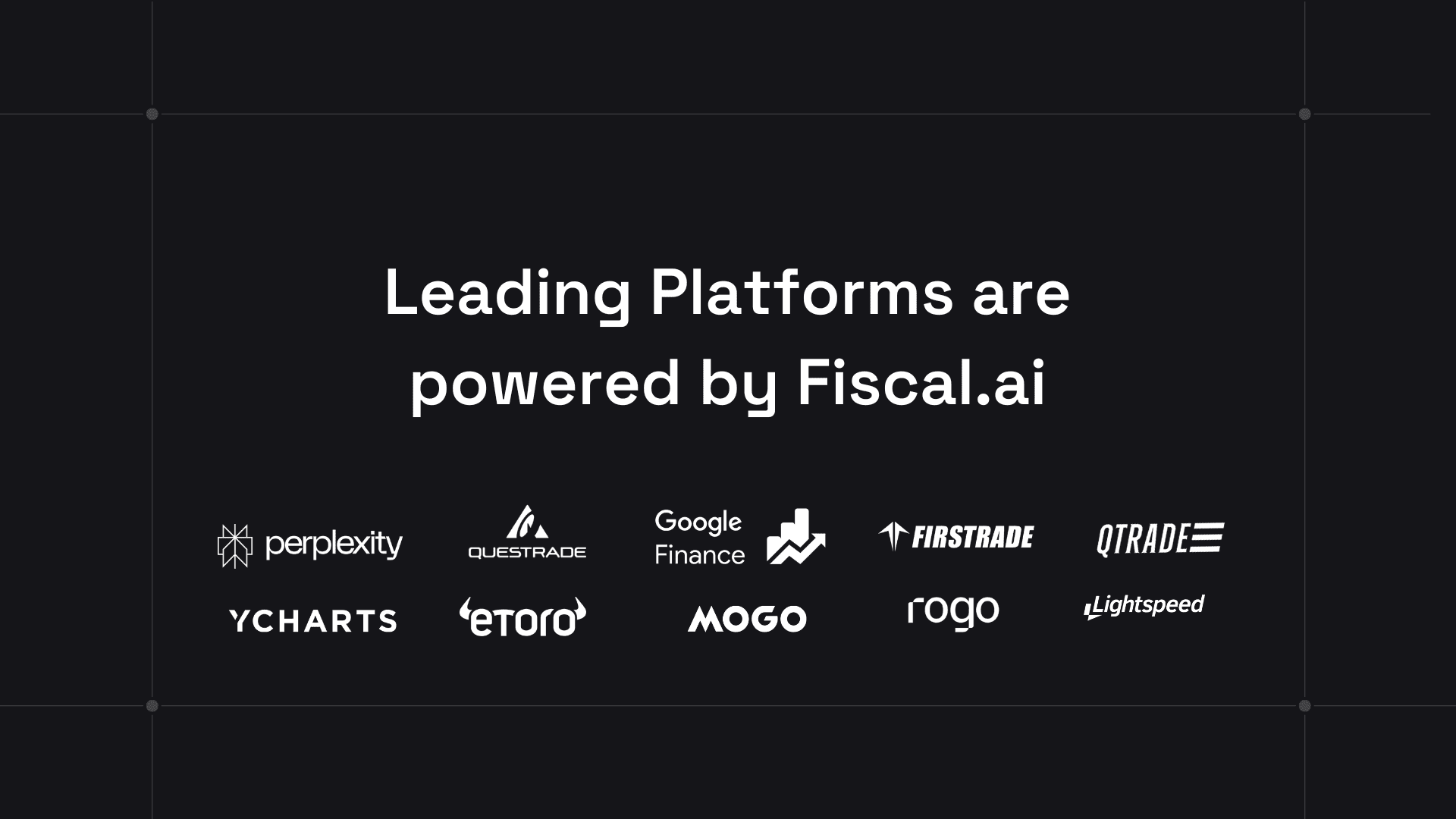

2. S&P Capital IQ: Largest Data Catalog

S&P Capital IQ is one of the largest and most reputable providers in the financial data industry. They are considered one of the 3 “high-end providers” alongside FactSet and Refinitiv.

As an aggregator of financial data for more than 4 decades, S&P now has among the most complete geographic coverage of any provider. Their fundamental data covers more than 99% of global market capitalization.

S&P Capital IQ offers the largest array of datasets for customers to choose from (219 datasets in total). These range from broad solutions like standardized fundamental data and consensus estimates, to more niche datasets like EU taxonomy data and ESG scores.

S&P aggregates its fundamental data primarily through manual data collection. This includes multiple layers of entry, review, and approval, which helps S&P score as one of the most accurate providers.

Pros

S&P has built best-in-class depth and breadth of data over the years. Not only do they provide wide geographic coverage, but customers can pick and choose the datasets that are the most important to them.

Cons

Due to their process of manual data collection, some customers report slow delivery speeds. S&P's fundamental data can take multiple days to update after a company reports earnings.

Given their strong reputation and geographic coverage, S&P is also one of the more premium-priced providers on this list.

Scoring:

Coverage (Geographies & Endpoints): 3/3

Latency/Speed: 1/3

Accuracy: 3/3

Pricing: 1/3

Combined Score: 8/12

For larger budget teams requiring a wide range of datasets, S&P Capital IQ is a great choice.

See the full coverage here.

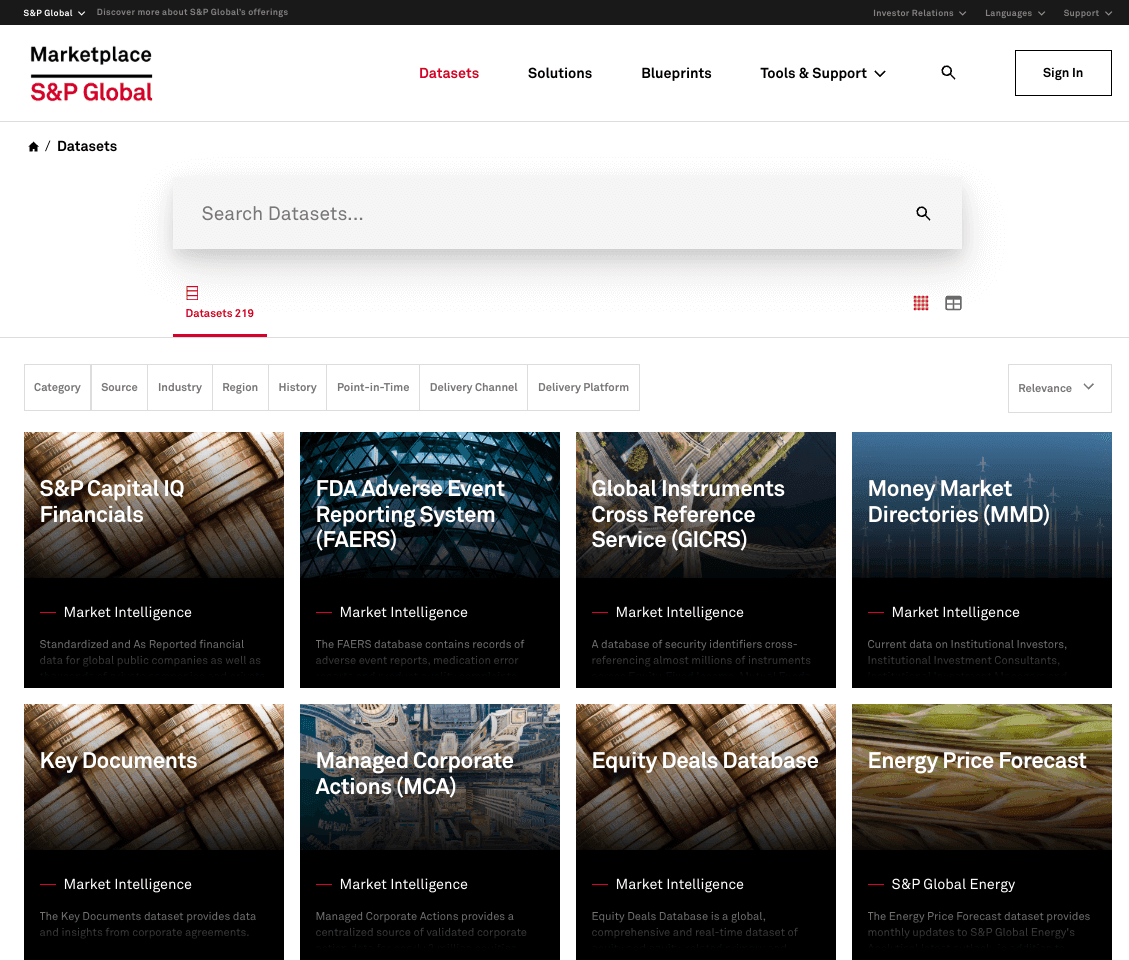

3. FactSet - Widest Geographic Coverage

Like S&P Capital IQ, FactSet is one of the longest standing financial data providers globally.

FactSet is considered a premium financial data provider with an extensive API catalog. They have 200+ Data Feeds and APIs including end-of-day prices, 20+ years of fundamental data, events & transcripts, company logos, and much more.

FactSet’s pricing data covers virtually every corner of the globe including 194,000+ international companies (both active and inactive), and 1.1+ million listings across 187 exchanges.

Additionally, FactSet bought CUSIP Global Services in 2022, the company behind the CUSIP security identification system. The SEC and FINRA require all securities in North America to have a nine-character CUSIP number to ensure market efficiency and help with regulatory oversight.

With CUSIP under FactSet’s ownership, they now provide direct access to the CUSIP database via their APIs. This eliminates the need for clients to source this from third parties.

Pros

While FactSet has lots of data overlap with Capital IQ and Refinitiv, each have particular strengths in certain industries.

In FactSet’s case, they have great global coverage on multiple asset classes including robust fixed-income data and broad economic indicators. Additionally, customers have given positive feedback about their technical support, which can be critical for complex integrations.

Cons

As one of the longest standing providers, FactSet has developed a robust manual process for collecting data over the years.

While this helps ensure higher accuracy than traditional parsing technology, it leads to slow delivery times for fundamentals. Income statement, balance sheet, and cash flow statement data can take multiple days to update after a company reports earnings.

Scoring:

Coverage (Geographies & Endpoints): 3/3

Latency/Speed: 1/3

Accuracy: 3/3

Pricing: 1/3

Combined Score: 8/12

If you're looking for the widest geographic and listing coverage, FactSet would be a great choice.

See FactSet's full coverage here.

4. Refinitiv - Best for News and Research

Refinitiv was acquired by the London Stock Exchange Group (LSEG) in 2021 and they are the last of the “3 high-end providers”.

Like the S&P Capital IQ and FactSet, Refinitiv offers 20+ years of high quality fundamental data on companies all over the globe.

On the fundamentals side, Refinitiv offers Standardized & As-Reported financials as well as click-through auditability. Both these features give customers greater visibility into financial statement data and help establish trust.

Additionally, Refinitiv provides Point-in-Time data, which is critical for backtesting trading strategies.

One area where Refinitiv really stands out is in its News and Research APIs. While FactSet, S&P, and Refinitiv all redistribute news from other providers, Refinitiv is the only one that includes Reuters thanks to their longstanding ties. Reuters has 2600 journalists in nearly 200 locations delivering international and local news with speed and insight.

Pros

Refinitiv is often touted as one of the best providers for real-time news and research.

Beyond news, they also offer a fairly wide breadth of financial datasets, so there may be a good chance to bundle multiple offerings with one provider, depending on your needs.

Cons

Refinitiv receives the same knocks as FactSet and S&P in that they’re on the higher end cost-wise and can be slow for fundamentals.

Coverage (Geographies & Endpoints): 3/3

Latency/Speed: 1/3

Accuracy: 3/3

Pricing: 1/3

Combined Score: 8/12

If news and research is a high priority for your project, Refinitiv might be the best choice.

See Refinitiv’s full coverage here.

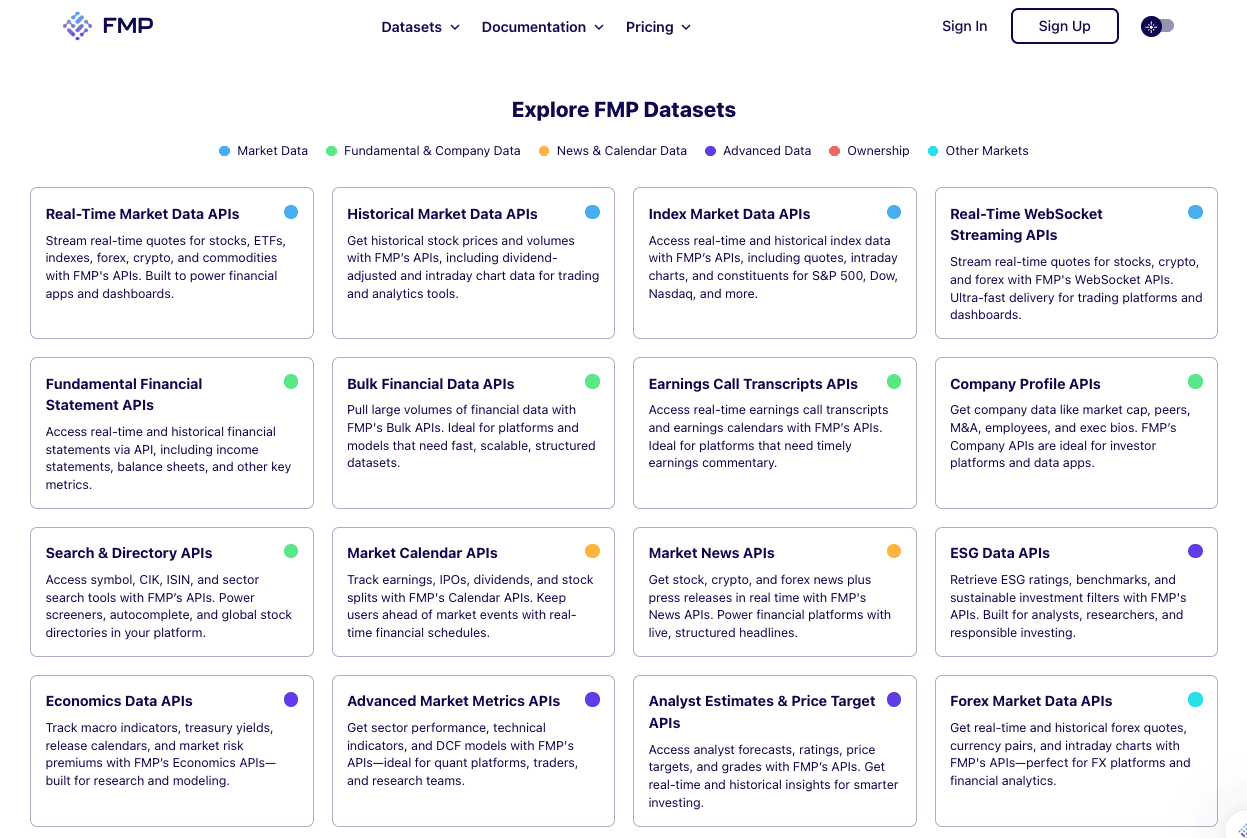

5. Financial Modeling Prep: Best for Low-Budget Projects

Financial Modeling Prep (FMP) is a great solution for cost-conscious projects.

FMP provides a wide array of endpoints including real-time and historical prices across equities, ETFs, mutual funds, indexes, commodities, cryptocurrencies, and foreign exchange pairs.

Beyond pricing data, FMP also offers data for financial statements, 13-F holdings, company profiles, and more.

If you’re on a budget, and you want a single provider that meets a variety of your needs, FMP might be a good fit for you.

Customers report that their API is easy to implement, and that customer support is very quick in their response times.

Pros

FMP is the only provider on this list to score a 3 out of 3 on pricing.

Their ultimate plan provides several datasets and up to 3,000 API calls per minute for just $99/mo.

Cons

FMP scores the lowest on this list for data accuracy.

In reading customer reviews, the most common knock against the company is that the data is often inaccurate. This can lead to end-users losing trust in a product or platform.

If you find that FMP is the right provider for you, we recommend choosing a sample of global companies and comparing the accuracy against other providers.

Scoring:

Coverage (Geographies & Endpoints): 3/3

Latency/Speed: 1/3

Accuracy: 1/3

Pricing: 3/3

Combined Score: 8/12

If you need a wide range of endpoints and cost is your primary consideration, FMP is a great choice.

See the full coverage here.